Customer Attrition rate and how it can affect your company

Customer attrition is a key measure of customer loyalty, but knowing how to calculate the customer attrition rate can be challenging. In this article, we will explain what customer attrition is and how to calculate your company’s customer attrition rate so that you can work to optimize it for success.

What is Customer Attrition?

The loss of customers by a company is known as customer attrition. Most customers of a particular company won’t continue to be active clients forever. Every consumer will eventually sever ties with the company, whether they were a one-time buyer or a devoted client for many years. Numerous terms, such as customer attrition, customer churn, customer turnover, customer cancellation, and customer defection, are used to describe the phenomena of “disappearing” clients. Customer survivorship, on the other side, measures how long consumers remain loyal before leaving. The percentage of customers that remained engaged over time is known as the survival rate.

5 Steps to follow when calculating customer attrition rate

- Identify your current customers and the revenue they generate: To calculate your company’s customer attrition rate, you first need to identify the customers who are currently active and generating revenue. Make a list of each of these customers and the revenue they generate for your company. This will help you determine how much money your company stands to lose in the event that any of these customers terminate their relationship with your business.

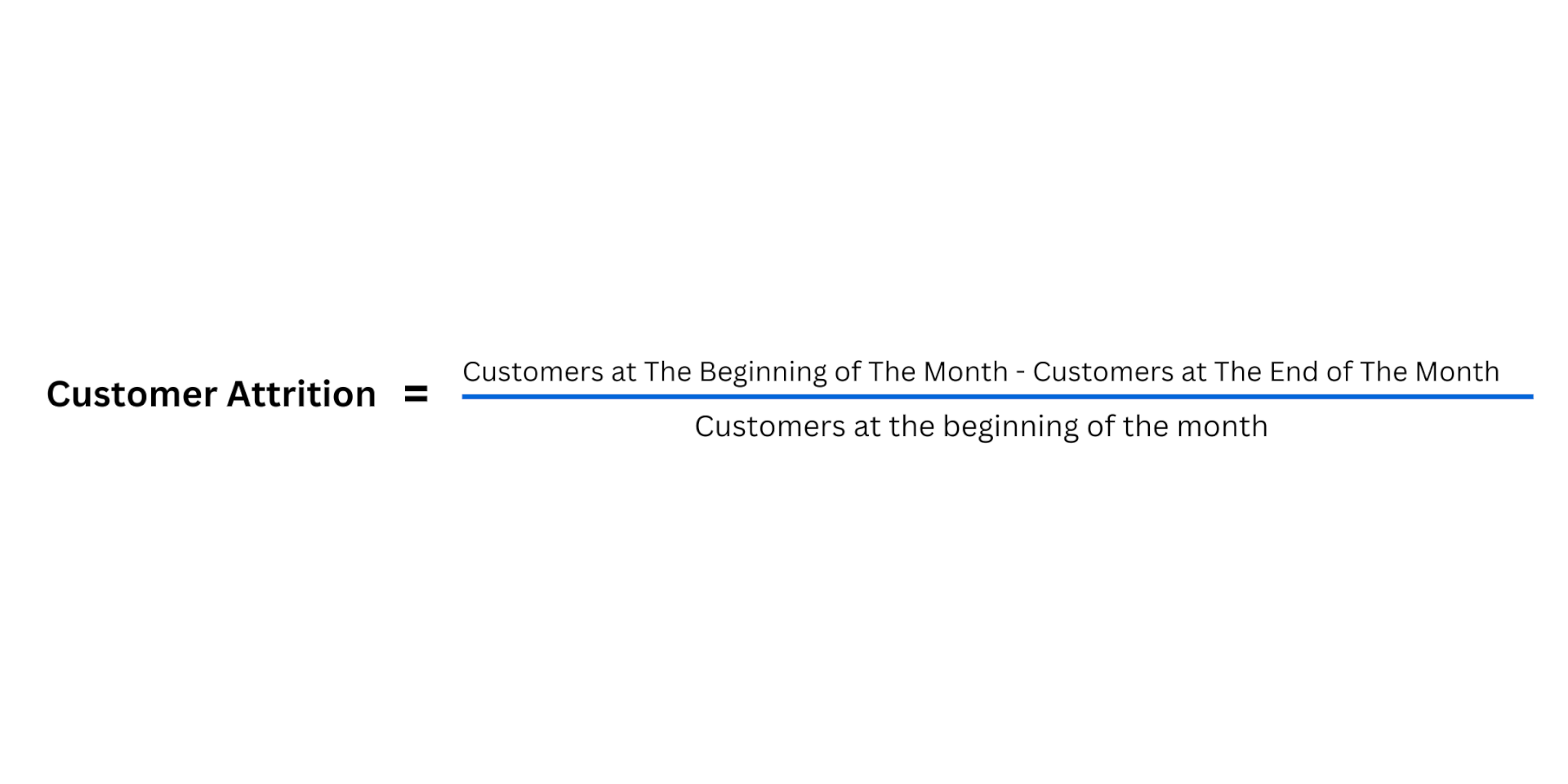

- Track customer retention information for a full year or longer: To get a fuller picture of your customer attrition rate, it is important to track customer retention information for a full year or longer. Track how many customers each month have either retained their services or terminated them. Then calculate the total number of customers that remain after each month and subtract this number from the total at the beginning of the month. The difference will represent customers lost through attrition each month. You can then divide this result by the total amount of customers your business had at the start of the period to obtain an accurate percentage representing customer attrition over time.

- Calculate attrition rates for different periods of time: To get a fuller understanding of customer attrition trends at your company over time, you can calculate the attrition rate for different periods. This is useful as it allows you to compare how the rate has changed between monthly and yearly increments. Monthly calculations are essential for detecting sudden shifts in customer retention and acting fast to maximize customer loyalty, whereas annual calculations provide a longer-term view of success. It’s important to pay attention to both metrics in order to make informed decisions about how best to improve customer satisfaction and decrease attrition rates.

- Analyze customer loss data to identify patterns in churn rate: To gain the most detailed view of customer behavior and your company’s consumer attrition rate, analyze customer loss data. This includes reviewing information on why customers are leaving, when they are departing, what products or services they paid for, how many orders they completed during their lifetime as a customer, how satisfied they were with your company’s product or service, etc. By having this information, you can spot any trends in customer churn rates from a particular product group or time period. Comparing the answers to these questions can help you identify any issues that may cause customers to leave and make it easier for you to reduce overall customer churn.

Read Also: Facebook Marketing Mistakes

- Implement strategies to reduce customer attrition and improve overall customer loyalty practices: To reduce customer attrition and improve the overall customer experience, companies must develop and execute strategies for improvement. These strategies can include incentives for customer retention, such as loyalty program rewards or special discounts. Companies should also focus on providing excellent customer service and creating a more personalized customer experience. Additionally, it is important to invest in marketing research to understand how customers are interacting with your brand, what they need from it, and which features or services they find most valuable. Implementing these strategies can help reduce customer churn and increase customer loyalty over time.

Customer Attrition Formular